With buyers facing unusually long delays between ordering and receiving new cars, car manufacturers are pivoting to make key components, including semiconductor chips and lithium-ion batteries. The change has been driven by ongoing chip shortages. In April 2022 Pat Gelsinger, chief executive officer of leading chipmaker Intel in Santa Clara, California, told US TV channel CNBC that semiconductor shortages would last until 2024. With silicon also set to play a key role in improving battery performance, the automotive industry is reorganising itself to ensure it doesn’t face similar problems in the future.

Current silicon demand levels are exceptional, according to Karan Chechi, director at market research company ChemAnalyst in Mumbai, India. Yet supply of high purity silicon and other raw materials is limited, he stressed. “As the pandemic started, demand from the automotive sector plunged drastically,” Chechi explained. These materials were diverted to consumer electronics and photovoltaics. So, when the automotive sector ramped back up in late 2020, it couldn’t get the necessary supplies.

Demand from photovoltaics and consumer electronics remains strong, said Chechi. That has led to automotive chip shortages, meaning that internal combustion engine (ICE) vehicle sales fell in the first quarter of 2022. Shortages may ease in the second half of the year, Chechi added, when semiconductor chip shortages had been due to end. Normal supply chain function had been expected to resume in 2023, but that has been set back by the Russia-Ukraine conflict.

As such, vehicle makers now prioritise using the chips they have in electric vehicles (EVs), according to Yu Yang, senior technology and market analyst, power electronics, at Yole Développement, which is based in Lyon, France. EVs are usually higher-end and more profitable than ICE cars, which are often budget models. EV sales are still growing, even as car sales in general are falling, Yang noted.

Electric vehicles still have significant shortcomings, emphasised Yohan Oudart, R&D manager at high purity silicon nanoparticle powder manufacturer Nanomakers in Rambouillet, France. “There is a need to increase the battery capacity, the time between two charges,” he explained. “It's a key point to sell more EV cars because today their range is a bit too short.”

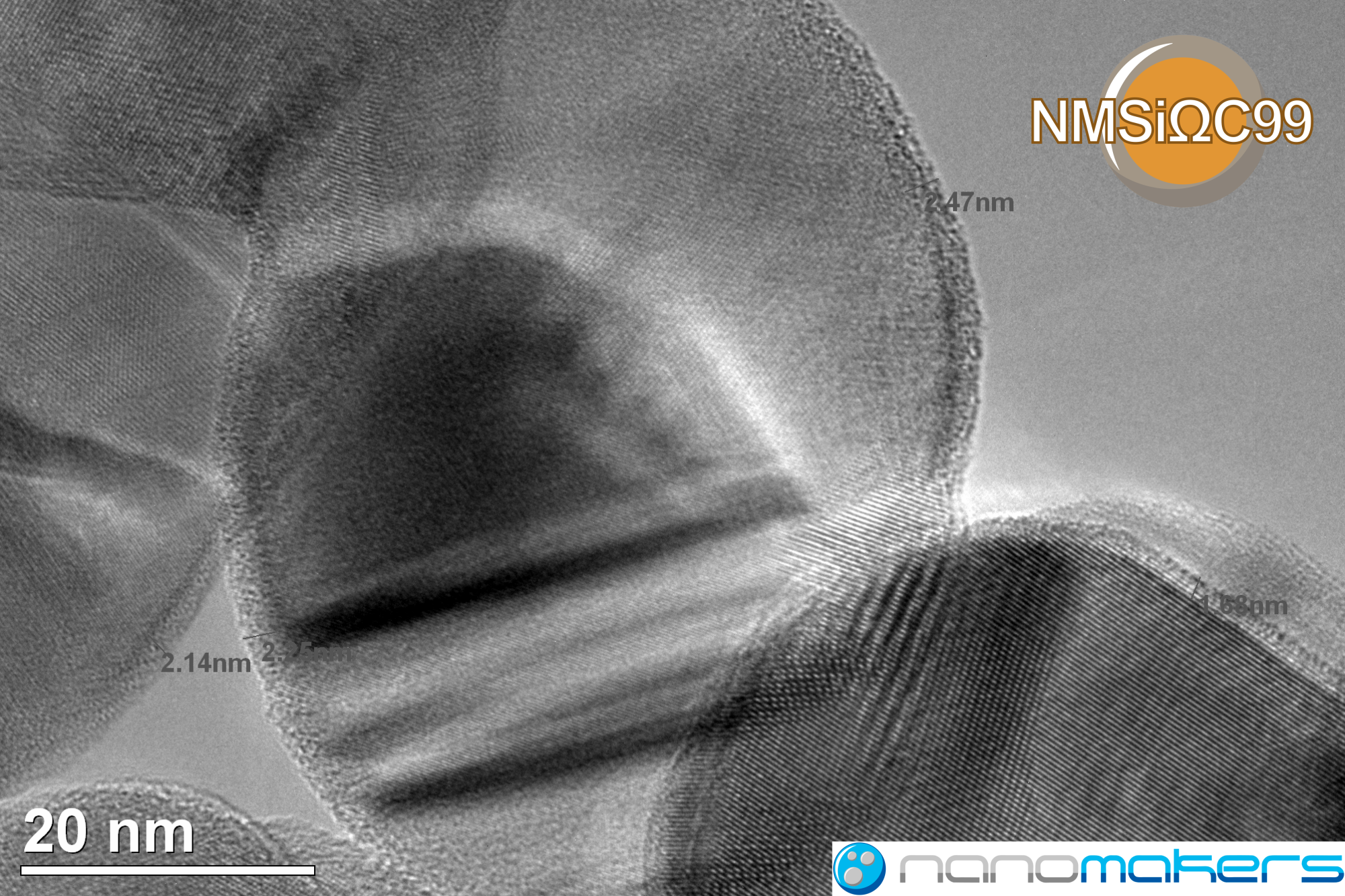

A key factor in determining the amount of energy that lithium-ion batteries can store is the materials used as their electrodes. One of their two electrodes is today usually a carbon-based material such as graphite. Oudart notes that replacing graphite with the same weight of silicon can store ten times the amount of energy. “However, today, we can't use it as pure; we need to mix it with carbon,” he said.” A graphite anode with 10% silicon can increase overall battery capacity by 20%, Oudart said. “It's a huge improvement,” he stressed.

NMSiΩC99_Nanomakers.png: Rambouillet, France-headquartered Nanomakers is developing silicon powder for use as car battery electrodes. Image credit: Nanomakers

NMSiΩC99_Nanomakers.png: Rambouillet, France-headquartered Nanomakers is developing silicon powder for use as car battery electrodes. Image credit: NanomakersRecognising this potential, electric vehicle makers such as Tesla are already using silicon oxide in their electrodes. However, “the capacity is limited,” Oudart noted. “To have better capacities we need to use silicon metal.” Therefore, Nanomakers is helping enable silicon electrodes as part of ASTRABAT, a European research project that aims to enable optimal solid-state batteries that are compatible with mass vehicle production.

Currently, production capacity exceeds demand for carbon and silicon electrode raw materials, according to Oudart. But forecasts suggest that enough gigantic electric vehicle battery factories, known as gigafactories, are being built to quadruple output, he added. Oudart is uncertain whether this will be achieved, but notes that silicon and graphite suppliers will need six to twelve months’ notice to match the ramp up.

Chechi stressed that there are already supply challenges for some materials. He noted that after the international COP26 climate meeting in Glasgow, UK, in October and November 2021, EVs have been at the forefront of green economy initiatives. That has led companies to invest, seeking to capture market share. Demand surged, leading to delayed deliveries and “skyrocketing” prices of a few essential battery raw materials. “In order to cope with the demand, several market players are working on the development of the infrastructure,” Chechi said.

As part of this, commercialising silicon-based electrodes has “opened the door” for new investments, according to Chechi. Although today the value of batteries using silicon electrodes is limited, he predicted that they would be used in large-scale manufacturing by 2025.

Batteries and semiconductor chips therefore both share key sourcing challenges that are driving car manufacturers to get more deeply involved in their supply chains, Yang revealed. “For the future of EV, both the power electronics and the batteries are the critical parts,” he said. “Before, if they needed them, they just asked their tier-one suppliers to do the sourcing for them,” he said.

These tier-one companies would specialise in working directly with vehicle makers, securing components like chips and battery packs that they need. But now vehicle makers “have direct cooperation or strategic relationships with the device suppliers or even the materials suppliers, which is quite uncommon, not seen before,” Yang continues. For batteries, this might include vehicle makers investing in mines.

These critical components are also shifting the automotive industry’s focus away from the previous globalisation trend to more localised supply chains. The US-China trade war had started this trend, commented Yang, then the pandemic “made it more evident”.

Semiconductor chips will remain largely globalised because they can be easily transported, he suggested. “But for the batteries, [localisation is] quite evident, because the battery is half of the weight of the car,” Yang said. “Shipping from another part of the world is not good for the environment. The battery takes 30%, sometimes even 40%, of the total value of the car. You need to think of ways to keep that value within your system.”

These strategic changes are no doubt important, but their impact is perhaps more significant for car buyers than vehicle makers. Manufacturers have been “doing very well” in terms of profits, noted Yang. “There are fewer cars, so more demand, increasing the price of the car.” Many people therefore stand to benefit from a more competitive supply chain.

youris.com provides its content to all media free of charge. We would appreciate if you could acknowledge youris.com as the source of the content.